While businesses continue to search for people to fill their jobs, two things will be making that more difficult.

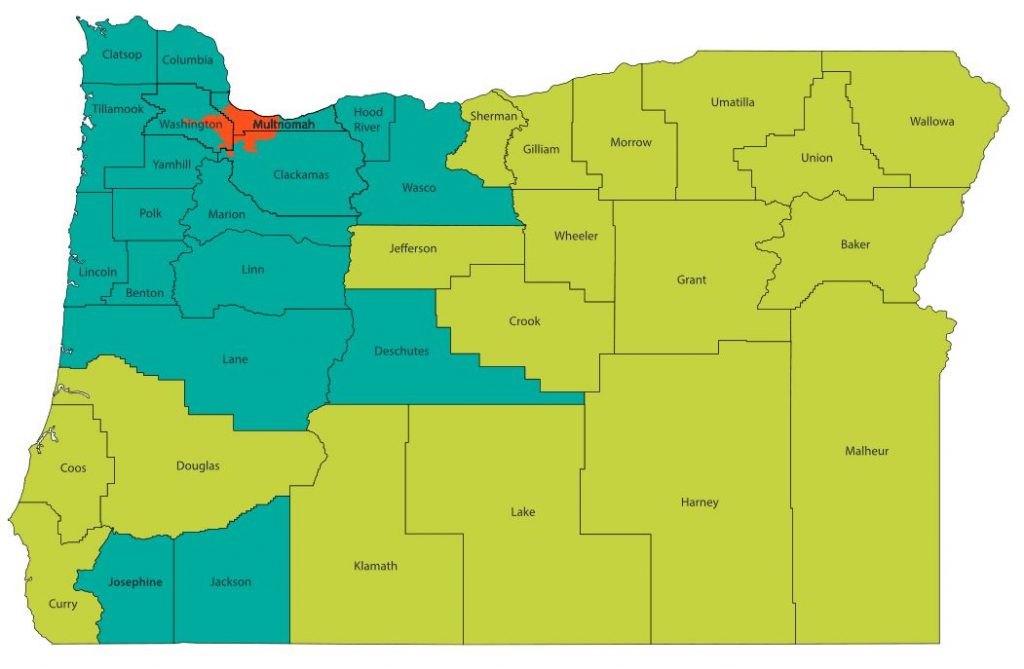

Beginning July 1, the cost for employees will be officially going up again. Minimum wage in Oregon will go up to $14.75 per hour in the Portland area, and will increase for Benton County from $12.75 to $13.50 per hour. Yet, the average hourly wage in Corvallis as of May ranged from approximately $17 to $55 – 25% higher than the state mandated minimum.

To add to the issue, Oregon State University has ended the school year, meaning local businesses may be looking for extra hands. With an unemployment rate of only 2.9% in April, that means finding people to work in Corvallis will continue to be difficult.

The 1,000 Foot Rule: An issue came up in a recent Corvallis City Council meeting about the 1,000 foot rule. Small business owner Ryan Weber was surprised to be denied a license to sell tobacco products from his smoke shop because his location was less than 1,000 feet “as the crow flies” from both the downtown Safeway. and Dairy Mart.

Proponents were concerned about kids having access to tobacco when the city ordinance was implemented. But Weber says he doesn’t want to sell tobacco products to minors and his business is being limited unfairly. His store, which sells bongs and pipes for use with cannabis, is open only to those 21 and over.

Weber says that even in 2017 when the rule was first put into place, the councilors in Corvallis expressed concern for smaller tobacco sellers, saying “maybe they shouldn’t be standing in the way of retailers and what they’re selling.” When Weber bought the shop from the previous owner, neither realized that they would be put in the position of not being able to secure a license to sell tobacco.

Will the City Council make exemptions for business owners like Weber? Currently, lobbyists for local businesses are meeting with City officials.

Little known I-Bond was built for inflationary periods: As you probably heard, the United States Federal Reserve took aim at inflation last week, raising their interest rate by 0.75%. Most economists quickly pointed out the increase wouldn’t substantially slow inflationary pressures until after first quarter next year, and that even then the current price spiral is also driven by supply chain issues, and quite notably, oil.

For savers and investors, this is a difficult time. The stock market has been up and down lately – more often down, and traditional investments are showing lower rates of return while interest rates on credit are getting higher. So let’s take a look at the almost unknown and slightly boring I Bond, which the U.S. government developed decades ago for times just like these.

The Series I Savings Bond – named because their interest rate is linked to the inflation rate – is the underdog of the savings bond world. Yet in January of 2022, the U.S. Treasury sold about $3 billion in these bonds, which currently carry a guaranteed return rate of 9.62% if purchased before the end of October, 2022.

The rates for these bonds are set two ways. There is a Fixed Rate – currently set at 0.0% although it does go up, and an adjustable rate based on inflation, which is determined on May 1 and November 1 of each year. Money invested in I Bonds – which is capped at $10,000 per person per year – can be cashed out after 12 months, meaning these are not great for people who need easy liquidity in their investments.

If you’re interested in these bonds, you can go to the federal website to purchase them – meaning, yes, they are electronic in nature, but still backed by the federal government and therefore more stable than cryptocurrency. Note that these do not beat inflation, but rather protect you from inflation over the long haul – maturing fully in 30 years – and are safe, if a bit boring.

Also, for those worried about personal debt and investing, experts suggest transferring high interest rate debt to lower interest cards or home equity loans, and to stay focused on long term goals in their investments.

“Backing Small” Businesses Grants: The time to apply for one of a series of small business grants is coming to a close at the end of June. If you meet the conditions and need a little assistance in getting back on your feet after the pandemic, this might be for you.

If you are a small business owner who owns at least 51% of the business and who is:

- Native

- Indigenous

- Hispanic

- Latinx

- LGBTQ+

- Immigrant

- Forcibly displaced

And if your “brick and mortar” business is located in an older or “historic” commercial district – this leaves out businesses in strip malls, shopping malls, and residences; if you have fewer than 20 employees – including owners; if you’ve been in business since Jan. 1, 2021; and if you are over the age of 18, then you should be eligible.

The expenses these grants are meant to cover include:

- Physical improvements to business.

- Equipment to comply with health and safety guidelines as set by the city or county.

- Fees to allow you to move into e-commerce.

- Professional services such as business plan modification.

- Basic business expenses such as rent, payroll, or operating expenses.

The last opportunity to access these $5,000 grants ends June 30, 2022. Go to the Backing Small Businesses website to read more or to apply.

For other business grants, look into the federal centralized grant website. This site creates a single spot to find over 1,000 grants that award more than $500 billion each year.

And Don’t Forget: This Thursday, June 23, the Corvallis Chamber of Commerce will be welcoming Nick Starita, the Division President of Energy Solutions at Hollingsworth & Vose, to speak at the latest in their Lunch Forum series. Starita will be talking about innovations in batteries to transform our fight against climate change. Go to the Chamber’s website for details.

By Sally K Lehman

Do you have a story for The Advocate? Email editor@corvallisadvocate.com